Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Tuesday, April 19, 2016 by Chittorgarh.com Team | Modified on Tuesday, November 9, 2021

ICICIdirect Account Opening

ICICIdirect Neo Plan - Flat Rs 20 per trade brokerage (Intraday and F&O) + Free Account Opening + Get funds in 5 minutes from sell orders + Free trading tips. Open Instant Account Now

ICICIdirect commodity trading account offers trading in commodity derivatives of gold, silver, crude oil, metals and agricultural products at Multi Commodity Exchange (MCX). An individual can open an online ICICI Demat and Trading Account with ICICIdirect and trade commodities online by paying a low brokerage of flat Rs 20 per executed order.

ICICI Commodity Trading Benefits

ICICI 3-in-1 online trading account offers commodity trading to retail investors in India. A customer can trade in futures and options of products like agriculture (wheat, cotton, etc.), minerals (petroleum), and precious metals (gold, silver, etc.). Commodity F&Os are traded at commodity exchanges like MCX and NCDEX.

ICICIdirect customers can trade commodities online using multiple trading platforms like ICICIdirect Mobile App, Website and Trading Terminal.

ICICIdirect Commodity trading account is a 3-in-1 account that includes a bank, trading and demat account. These three accounts are interlinked together to offer a seamless online trading experience. The ICICI 3-in-1 account allows you to trade in Equity and Equity/Currency/Commodity Derivatives. It also provides online investment products like IPO, Mutual Funds, ETF, Debt Funds, Insurance, Loan etc.

Follow the below steps to open an ICICI 3-in-1 account:

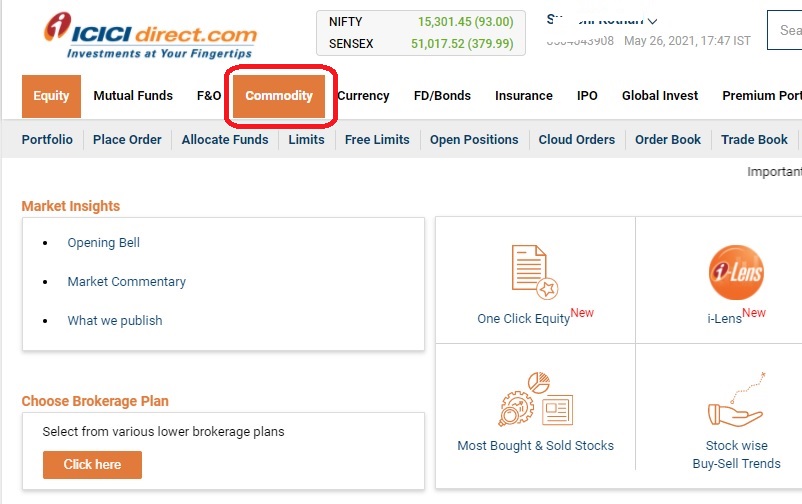

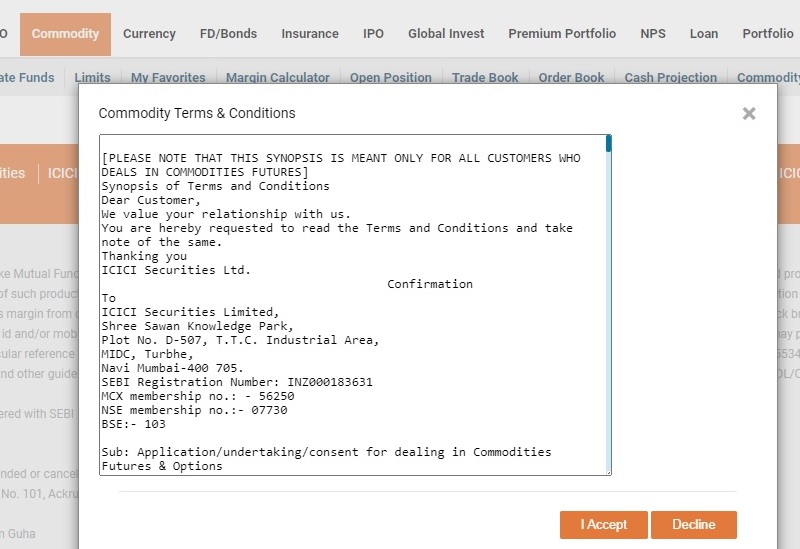

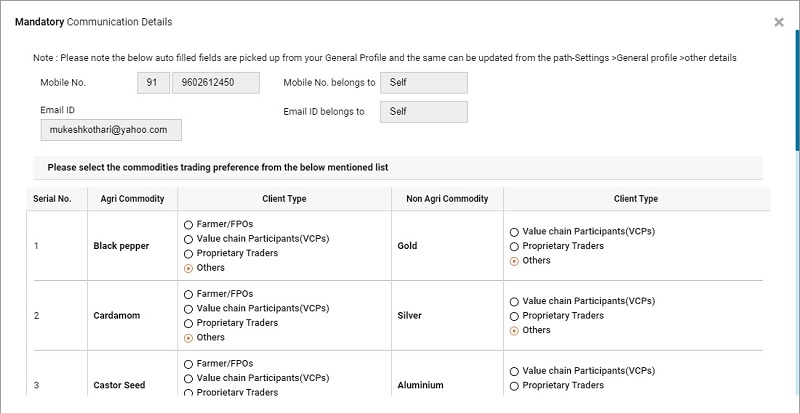

If you are an existing ICICI 3-in-1 account holder, the following are the steps to activate the ICICIdirect Commodity account:

'Congratulations! Your ICICIdirect trading account is now enabled for trading in the Commodity Derivatives segment (MCX).

You can start trading in the MCX Commodity segment with your existing User ID & Password in commodities like Gold, Silver, Crude Oil, Copper etc.'

ICICIDirect commodity charges are flat Rs 20 per order irrespective of the size of the trade. ICICI charges Rs 300 as demat AMC and Rs 50 per trade for using call & trade facility. Fund transfer and research services are available free of charge for all customers.

|

Transaction |

Charges |

|

Commodity Futures Brokerage |

Rs 20 per trade |

|

Commodity Options Brokerage |

Rs 20 per trade |

|

Demat AMC |

Rs 300 per year |

|

Call and Trade |

Rs 50 per trade |

|

Fund Transfer |

Rs 0 (Free) |

|

Research Charges |

Rs 0 (Free) |

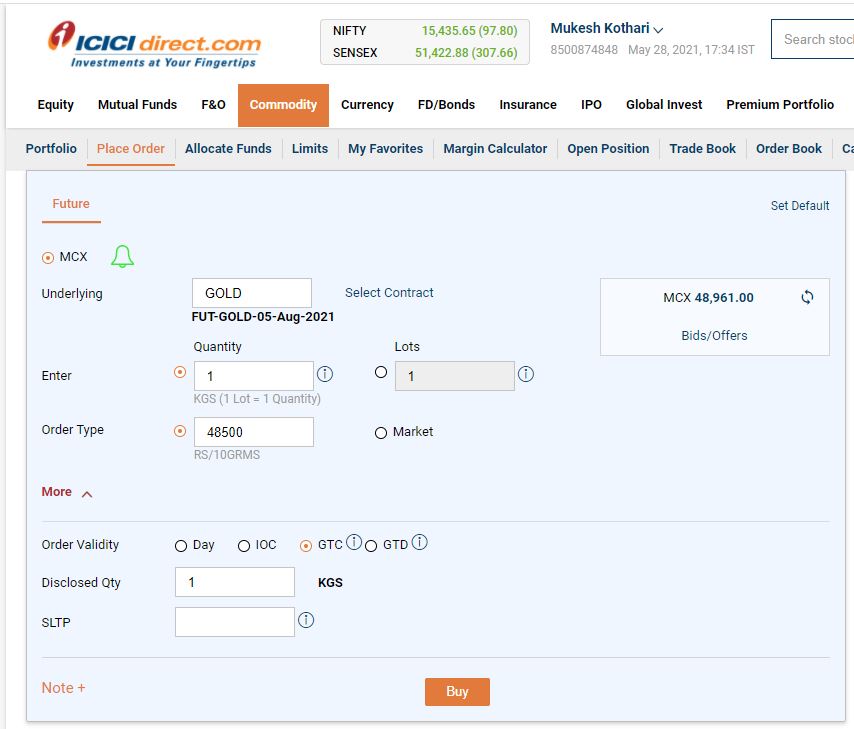

An ICICIDirect customer can buy commodities online using the ICICIDirect.com website, mobile app or an installable trading terminal trade racer.

Steps to buy commodities in ICICIDirect

Customers need to deposit margin money before start trading in commodity futures and options with ICICIdirect.

As per new margin policy by SEBI (applicable from September 2021), all broker offers the same margin. Check SEBI statement as below:

'Initial Margin and extreme loss margins shall be collected from the client on an upfront basis. It must be ensured that all upfront margins are collected in advance of the trade. Other margins such as Mark-to-market margin (MTM), delivery margin, special/additional Margin or such other margins as may be prescribed from time to time, shall be collected within 'T+2' working days from their clients.'

ICICIdirect Commodity Customer Care number is 1860 123 1122. This line is open from 08:30 AM to 06:00 PM (Monday to Friday). ICICIDirect customers can call this number for help, call & trade, and complaints.

ICICIdirect Customer Care number for NRI customers is +91-22-3914 0422. The NRI phone lines are open from 08:30 AM to 06:00 PM IST (Monday to Friday).

ICICIdirect is among the most trusted broker in India. It offers one of the best online trading platforms and low-cost commodity trading at MCX. It charges flat Rs 20 per trade brokerage irrespective of the trade size for trading at MCX. It is equivalent to leading discount stock brokers like Zerodha and Upstox. In addition, you get free research, margin against shares at low-interest cost and fund payouts in 30 minutes.

Open a 3-in-1 account with Neo Plan for:

Interested in opening a trading account? Open Instant Account Now

You can trade commodities in ICICIDirect if you are a customer and the commodity trading segment is enabled. ICICI Direct offers online commodity trading at MCX for flat rate brokerage of Rs 20 per executed order. You also get free research and margin funding at a low-interest rate.

ICICI Direct offers online commodity trading on its website ICICIDirect.com, ICICI Direct Mobile App and an Installable Trading Terminal.

ICICI charges Rs 300 for demat AMC and Rs 50 per trade for call & trade. Fund transfer and research are free of charge for all customers.

To buy commodities in ICICIDirect, an ICICI Direct customer has to activate Commodity Trading Segment. Once activated, you can buy them by login on to ICICIDirect.com or mobile trading app.

Steps to buy commodity online in ICICI Direct

Open ICICI Direct Commodity Trading Account online and start trading in just a day. ICICI Bank offers free instant account opening for commodity trading. ICICI Direct is among the most trusted broker to offer commodity trading.

ICICI Direct charges flat Rs 20 per executed order brokerage for trading in Commodities at MCX. It is the lowest brokerage in the industry. In addition, you get free research and recommendations, free fund transfer and the facility to withdraw the funds in just 30 minutes.

Yes, ICICI Direct offers commodity trading at MCX for flat Rs 20 per trade brokerage. In addition, you get an excellent online trading platform, free commodity research, free fund transfer, margin funding at a low-interest rate and the ability to with funds in just 30 minutes.

To trade in the commodity, Open ICICI Direct Commodity Trading Account online and start trading. ICICI offers free instant account opening for commodity trading.

If you are new to ICICI Direct, open ICICI Direct Commodity Trading Account online and start trading in just a day. ICICIDirect charges Rs 0 account opening free and opens the account instantly.

If you are an existing ICICIDirect customer, you could activate the commodity trading segment in two steps and start trading in 24 hours. Check for steps to active ICICI Direct Commodity Segment.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|