Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Wednesday, October 19, 2016 by Chittorgarh.com Team | Modified on Tuesday, January 7, 2020

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

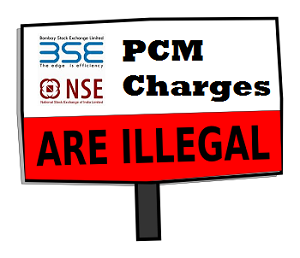

Brokers around India charges different PCM fees, a fee they say they pay to Professional Clearing Member. This fee is charged as a part of the Exchange Transaction Charges, which is collected by the broker on behalf of Stock Exchange where the trade is executed.

As per the exchanges, broker cannot charge any other fees than what is allowed by the exchanges. PCM fee is not part of this.

Lets start with more detail about this issue.

National Stock Exchange (NSE), Bombay Stock Exchange (BSE) and Multi Commodity Exchange (MCX) are three large exchanges in India offering verity of financial instrument for trading including equity, equity derivatives, currency derivatives and commodities derivatives.

Exchanges charge transaction fees (known as Exchange Transaction Charges) for trades executed with them. The rate of transaction fee varies by segments and by the exchange. The rates are published on the website of the exchange.

For equity delivery, equity intraday, equity futures, index futures and currency futures segments, the transaction charges are applicable on the value of the transactions.

For equity options, index options and currency options trading segments, the transaction charges are applicable on the Premium value.

The exchange transaction charge is part of 'regulatory charge's. Stockbrokers charges this fee to the client and pass it to the exchange.

As per NSE guidelines published on their website, following levies can only be charged to client in the contract note:

| Segment | Charges |

|---|---|

| Equity Delivery | Rs 325 per Cr |

| Equity Intraday | Rs 325 per Cr |

| Equity Future | Rs 190 per Cr |

| Equity Options | Rs 5000 per Cr |

| Currency Futures | Rs 110 per Cr |

| Currency Options | Rs 4000 per Cr |

| Segment | Exchange Turnover Fee | Sharekhan | Zerodha |

|---|---|---|---|

| Equity Future | Rs 190 per Cr | Rs 190 per Cr | Rs 210 per Cr |

| Equity Options | Rs 5000 per Cr | Rs 5000 per Cr | Rs 5300 per Cr |

| Currency Futures | Rs 110 per Cr | Rs 135 per Cr | Rs 135 per Cr |

| Currency Options | Rs 4000 per Cr | Rs 4220 per Cr | Rs 4400 per Cr |

Stock broker says the transaction change is combination of Exchange Transaction Fee and PCM Fee.

Most broker in India take services from Professional Clearing Member (PCM). PCM are member of exchange. They have the responsibility of clearing and settlement of all deals executed by the stock broker on the exchange. Typically banks or custodians become a PCM and clear and settle for brokers.

PCM charges a fee for clearing and settlement done through them by the broker.

As per NSE guidelines, the PCM fees should not be passed on to the client as is not part of allowed fees/charges a broker can change from the client.

This issue is explained in detail by the founder of ProStocks, a Mumbai based discount stock broker in a blog post 'Overcharging the Exchange Transaction Fee by Many Brokers in India'.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|